Optimization in Action

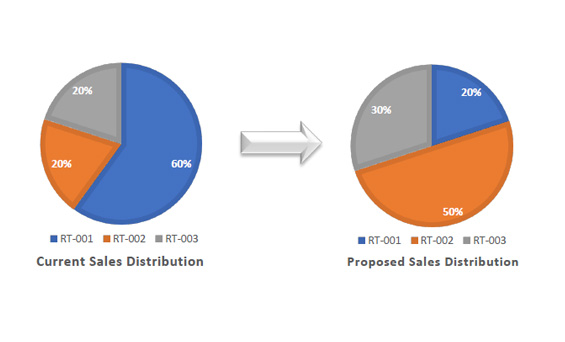

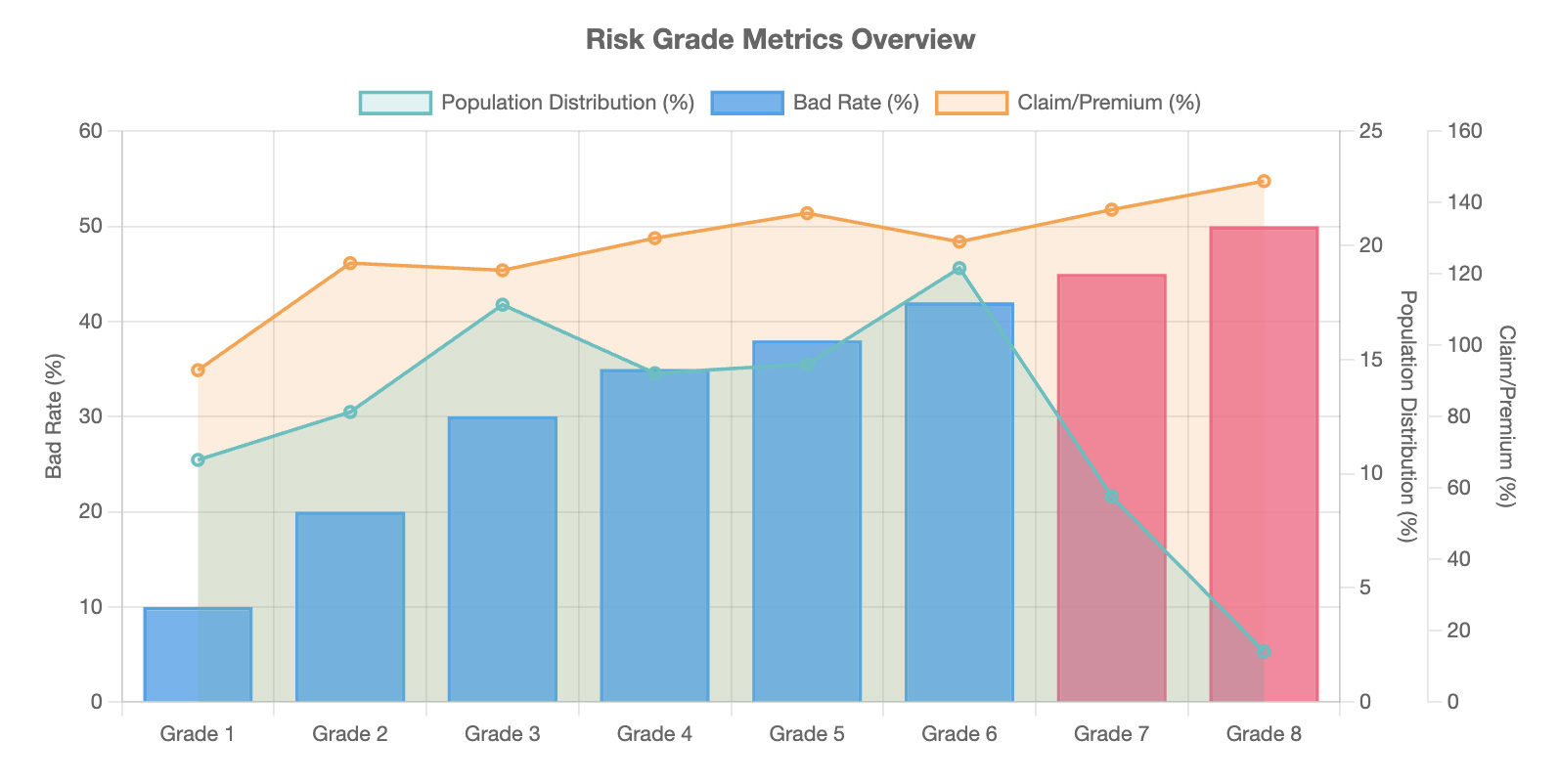

This case study examines how ProtoGene's innovative optimization engine transformed a leading life insurance company's sales strategy, resulting in significant profit margin increases and improved resource allocation. The solution not only addressed immediate challenges but also laid the groundwork for long-term strategic improvements.